In a globalized business environment, payroll is no longer a localized administrative task—it is a strategic function that must balance compliance, accuracy, scalability, and integration. XEE Payroll, developed by XEETEK and built on Microsoft Dynamics 365 Business Central, addresses these needs with a powerful, cloud-based solution tailored for organizations operating across multiple countries and legal jurisdictions.

Designed for businesses in Lebanon, the Kingdom of Saudi Arabia, Qatar, France, and other international markets, XEE Payroll simplifies complex payroll operations while ensuring strict adherence to local labor laws, tax regulations, and statutory reporting requirements.

Key Features and Functional Capabilities

Compliance with Multi-Country Regulations

XEE Payroll ensures full compliance with local laws and government regulations in each supported region. It automates statutory calculations and updates, reducing the risk of errors and non-compliance, and provides pre-configured rules tailored to specific countries.

Automated Income Tax Calculation

The solution supports progressive tax structures and regional exemptions, automatically calculating accurate deductions based on each employee’s salary and applicable tax bracket. This reduces manual intervention and minimizes the risk of tax-related discrepancies or penalties.

Social Security Contribution Management

Employer and employee contributions are calculated based on country-specific laws and updated automatically. XEE Payroll streamlines submission processes and maintains comprehensive reporting for relevant government authorities.

End-of-Service and Family Allowances

End-of-service indemnities and family-related benefits such as child or dependent allowances are calculated according to tenure, local labor laws, and company policies. The system supports country-specific gratuity formulas and enhances transparency in benefits management.

Loan Administration

XEE Payroll offers complete visibility and automation for managing employee loans. It tracks balances, calculates monthly deductions, and accommodates skipped payments or deferred installments without manual recalculations.

Insurance Policy Management

The system manages employee insurance programs, including health, life, and travel insurance. It supports cost-sharing models between employer and employee and ensures policy-related deductions are accurate and timely.

Bonus and Allowance Schemes

Flexible configuration allows companies to define and manage various types of bonuses, commissions, and performance-based incentives. Payments are calculated and disbursed automatically based on pre-set rules or milestones.

Additional and Deductible Allowances

Customizable frameworks enable the configuration of non-standard allowances such as transportation, overtime, and housing. These can be fully aligned with corporate HR and compensation policies.

Education-Related Benefits

The platform supports schooling and pre-schooling allowance management, automating the allocation and disbursement of education-related employee benefits as per internal policies.

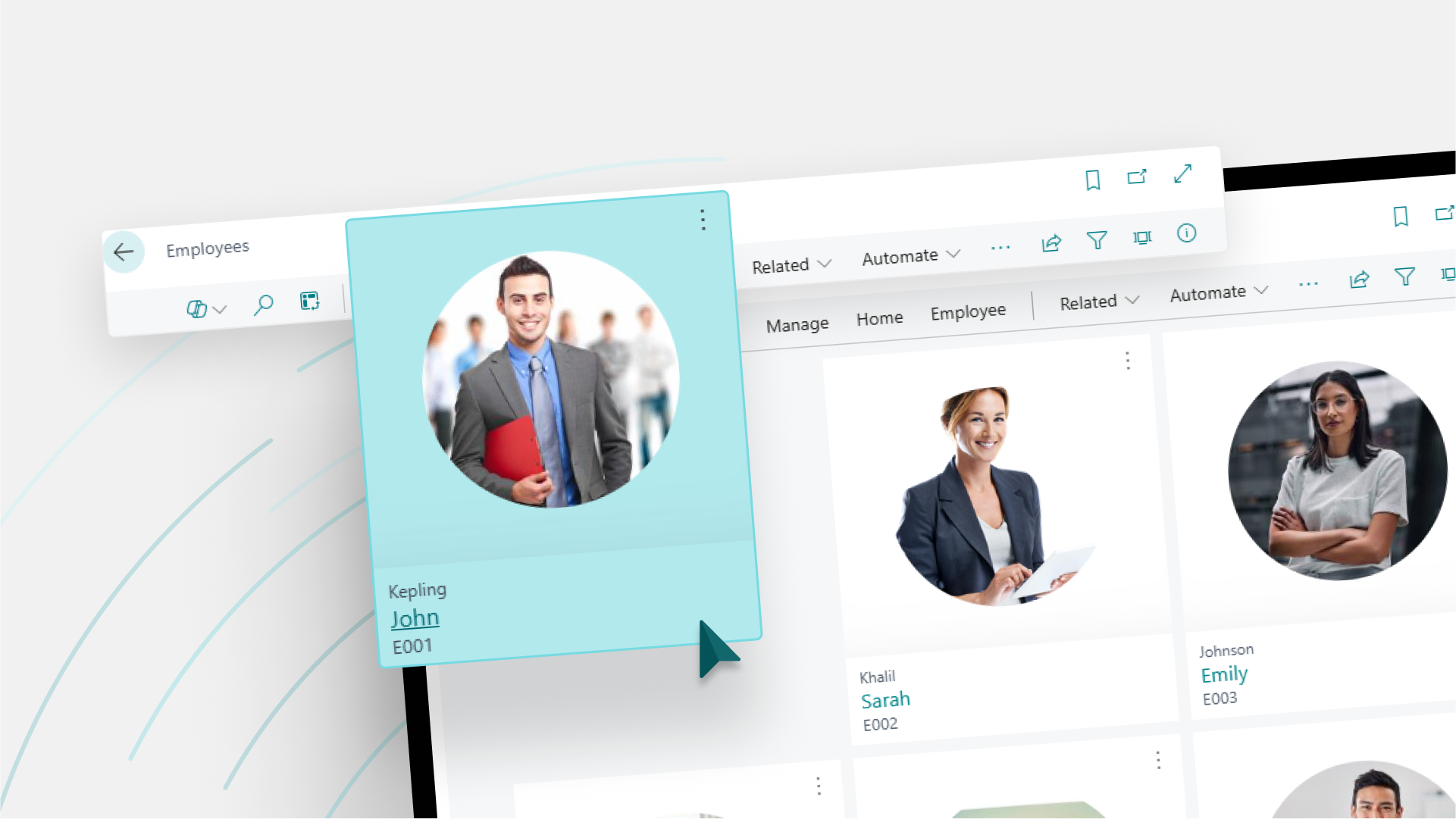

No-Code Configuration Environment

XEE Payroll provides a user-friendly setup interface that allows HR and payroll administrators to configure rules and parameters without requiring technical or development expertise. This significantly reduces IT dependency and improves agility.

Statutory and Compliance Reporting

The solution offers an extensive range of reports, including tax declarations, social security submissions, and end-of-service statements. All reports are aligned with local legal formats and are ready for submission to regulatory authorities.

Multi-Currency and Multi-Company Support

XEE Payroll accommodates multi-currency payroll operations for organizations operating across borders. It also supports centralized payroll processing for multiple legal entities within a single solution.

Seamless ERP Integration

Through robust APIs, XEE Payroll integrates directly with Microsoft Dynamics 365 applications and other ERP platforms. This bi-directional data flow ensures that payroll and financial data remain synchronized in real-time, eliminating manual entry and reducing the risk of discrepancies.

Strategic Value and Business Impact

XEE Payroll is not only a compliance-driven tool—it is a strategic enabler of business efficiency. By automating complex processes, reducing administrative overhead, and aligning payroll operations with financial systems, it improves organizational control, ensures audit readiness, and allows HR and finance teams to focus on higher-value tasks.

In addition to core capabilities, XEETEK offers multiple service tiers to meet varying levels of support, customization, and analytical needs. Premium options include advanced support services, Power BI dashboard development, and integration with employee self-service mobile applications.

Contact and Demonstration

XEE Payroll is trusted by leading organizations seeking to modernize and standardize payroll processes across regions. To learn how XEE Payroll can support your organization’s strategic goals, we would be delighted to show you how XEE Payroll can transform your payroll processes and support your business growth.